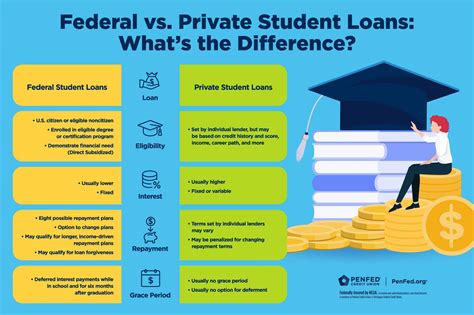

Private student loans are a type of financing that can help you pay for college or graduate school. They are different from federal student loans, which are issued by the government. Private student loans are issued by banks, credit unions, and other financial institutions. They typically have higher interest rates than federal student loans, and they may have other fees and restrictions. So, before you take out a private student loan, it’s important to understand the pros and cons. Do you have questions about the different types of private student loans? Are you wondering if you should consider getting one? Keep reading to learn more about private student loans and how they can help you pay for college.

What are private student loans?

Understanding Private Student Loans

Private student loans are a type of loan offered by private lenders, such as banks, credit unions, and online lenders, to help students cover the costs of their education. Unlike federal student loans, which are backed by the government, private student loans are not backed by the government and typically have higher interest rates and fees.

Benefits of Private Student Loans

There are a few benefits to taking out a private student loan. First, private student loans can provide you with more money than federal student loans. Federal student loans have annual and aggregate limits, while private student loans do not. This means that you can borrow more money to cover the costs of your education.

Second, private student loans can offer lower interest rates than federal student loans. However, this is not always the case, so it’s important to compare interest rates from multiple lenders before you decide on a loan.

Drawbacks of Private Student Loans

There are also a few drawbacks to taking out a private student loan. First, private student loans typically have higher interest rates than federal student loans. This means that you will pay more interest over the life of your loan.

Second, private student loans do not have the same repayment options as federal student loans. For example, you may not be able to qualify for income-driven repayment plans or loan forgiveness programs.

Third, private student loans can be difficult to qualify for. Lenders will typically require you to have a good credit score and a steady income.

Types of private student loans

Fixed-Rate Loans

Fixed-rate loans have an interest rate that stays the same for the life of the loan. This means that your monthly payments will be the same each month. Fixed-rate loans are a good option if you want to know exactly how much you will pay each month.

Variable-Rate Loans

Variable-rate loans have an interest rate that can change over time. This means that your monthly payments can also change. Variable-rate loans are typically riskier than fixed-rate loans, but they can also have lower interest rates.

Subsidized Loans

Subsidized loans are loans that have the interest paid by the government while you are in school. This can save you money on interest costs. Subsidized loans are only available to students with financial need.

Unsubsidized Loans

Unsubsidized loans are loans that have the interest paid by you. This means that you will pay more interest over the life of your loan. Unsubsidized loans are available to all students, regardless of financial need.

Comparing private student loans

Interest Rates

The interest rate is one of the most important factors to consider when comparing private student loans. Interest rates can vary significantly from lender to lender, so it’s important to compare rates from multiple lenders before you decide on a loan.

Fees

Private student loans can also have a variety of fees, such as origination fees, application fees, and late fees. It’s important to compare fees from multiple lenders before you decide on a loan.

Repayment Terms

The repayment terms of a private student loan can vary from lender to lender. Some lenders offer shorter repayment terms, while others offer longer repayment terms. It’s important to choose a repayment term that works for you.

Pros of private student loans

Higher Loan Amounts

Private student loans can provide you with more money than federal student loans. This can be helpful if you have high education costs.

Lower Interest Rates

Private student loans can offer lower interest rates than federal student loans. However, this is not always the case, so it’s important to compare interest rates from multiple lenders before you decide on a loan.

Flexible Repayment Options

Private student loans often offer more flexible repayment options than federal student loans. This can be helpful if you need to make changes to your repayment plan.

Cons of private student loans

Higher Interest Rates

Private student loans typically have higher interest rates than federal student loans. This means that you will pay more interest over the life of your loan.

No Income-Driven Repayment Plans

Private student loans do not have the same repayment options as federal student loans. For example, you may not be able to qualify for income-driven repayment plans or loan forgiveness programs.

Difficult to Qualify For

Private student loans can be difficult to qualify for. Lenders will typically require you to have a good credit score and a steady income.

Who should consider private student loans?

Private student loans may be a good option for you if:

- You have good credit and a steady income.

- You need to borrow more money than federal student loans allow.

- You want to lock in a lower interest rate.

- You want flexible repayment options.

Private student loans may not be a good option for you if:

- You have bad credit or no credit history.

- You are not sure if you will be able to make your monthly payments.

- You want the security of federal student loans.

How to apply for a private student loan

1. Gather Your Documents

You will need to gather a few documents before you can apply for a private student loan. These documents include:

- Your driver’s license or passport

- Your Social Security number

- Your tax returns

- Your W-2s

- Your transcripts

2. Compare Lenders

Once you have gathered your documents, you need to compare lenders to find the best loan for you. You should compare interest rates, fees, and repayment terms from multiple lenders.

3. Apply for a Loan

Once you have found a lender, you can apply for a loan. The application process will typically involve filling out an online form and providing your documents.

4. Receive Your Loan

If you are approved for a loan, the lender will send you the loan funds. You can use the loan funds to pay for your education expenses.

Repaying private student loans

Making Payments

You will need to make monthly payments on your private student loan. Your monthly payment will be based on the amount you borrowed, the interest rate, and the repayment term.

Managing Your Debt

There are a few things you can do to manage your private student loan debt.

- Make your payments on time.

- Consider making extra payments.

- Refinance your loan.

- Consolidate your loans.

Getting Help

If you are having trouble repaying your private student loan debt, you can get help from your lender or from a non-profit credit counseling agency.

Forbearance and deferment options for private student loans

Forbearance

Forbearance is a period of time when you can temporarily stop making payments on your private student loan. Forbearance is typically granted for a period of 6 to 12 months. You may be able to qualify for forbearance if you are experiencing financial hardship.

Deferment

Deferment is a period of time when you can temporarily postpone making payments on your private student loan. Deferment is typically granted for a period of 6 to 12 months. You may be able to qualify for deferment if you are enrolled in school, if you are unemployed, or if you are experiencing financial hardship.

Forgiveness options for private student loans

There are limited forgiveness options for private student loans. However, some private lenders offer loan forgiveness programs for certain borrowers. For example, some lenders offer loan forgiveness for borrowers who work in public service or who teach in low-income schools.

Scams to avoid when applying for private student loans

There are a number of scams to avoid when applying for private student loans. These scams include:

- Lenders who charge upfront fees.

- Lenders who guarantee approval.

- Lenders who offer loans with no interest.

- Lenders who pressure you to sign a loan agreement without giving you time to review it.

If you are approached by a lender who is offering you a loan that seems too good to be true, it probably is. Be sure to do your research and only borrow from reputable lenders.

The future of private student loans

The future of private student loans is uncertain. The government is currently